So, you have decided to embark on the thrilling journey of selling on Amazon in 2023? Excellent choice! Amazon is one of the world’s largest online marketplaces. It is an ideal platform for sellers worldwide to reach a massive customer base.

But where do you start? How do you navigate through the complex world of Amazon Germany? Our step-by-step guide is here to help you navigate this journey with ease and confidence. Whether you’re a seasoned seller looking to expand your market or a newbie venturing into the world of online sales for the first time, we’ve got you covered.

What You Need

Before we dig into the process of getting started with Amazon Germany, here is what you will need:

- Business License or Certificate / Gewerbeschein

- Tax ID Number / Steuernummer

- VAT Tax ID / Umsatzsteuer Nummer

- Identification Document

- Mobile phone

Steps for Selling in Amazon Germany

Without wasting much time, here is a complete step-by-step guide on how to start selling at Amazon Germany:

Step 1: Register Your Business with the Gewerbeamt

Before selling in the German market, you are required to submit your Gewerbeschein. This is basically a license that shows that you are allowed to do business in the German market. Generally, this license should cost around 20 to 60 Euros, depending on the city that you live in.

Before the Covid-19 pandemic, it was quite easy to register a business in Germany. In fact, you could visit the business registration bureau and get your business license that same day. Now, you have to either make an appointment, send a filled-out form by post, or apply only. Again, it all depends on the city you reside in.

Step 2: Apply for a TAX ID number (Steuernummer) and a VAT ID number

When done with the business registration step, you need to get a tax ID number and a VAT ID number. These are required because you will be selling products that have VAT included in their cost.

To get a tax ID number, you will need to fill out the Fragebogen zur steuerlichen erfassung (Tax Registration Questionnaire). While these forms are written in German, the process is straightforward. You will have to submit the completed form to your local Finanzamt (tax office).

Alternatively, you can apply for a tax ID number through Elster. Elster is basically your online tax office. The website will allow you to fill out the TAX ID registration form. However, take note that if you want to use the service, you have to register on the platform first then they will send a digital certificate to your address. You can only proceed to apply for the tax ID only when you get the digital tax certificate.

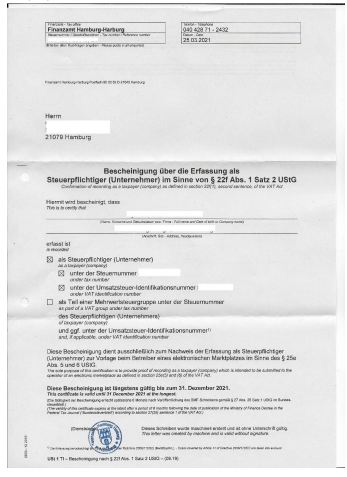

Below is a sample of a Steuernummer certificate:

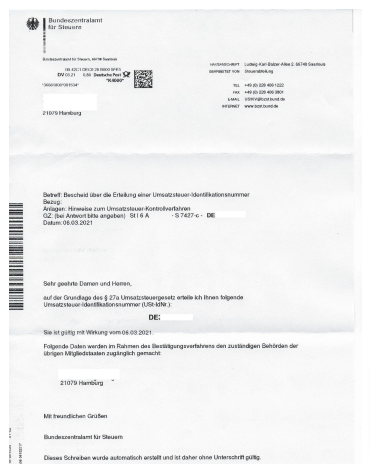

Here is also a sample of a Umsatzsteueridnummer Certificate:

Step 3: Create your Amazon Seller Central Account

With your business registration certificate, TAX ID number, and VAT ID number, you can proceed to create your Amazon Seller Central Account. The process is simple:

First, visit the Amazon Germany Seller Central website. Alternatively, copy this URL to your browser: https://sellercentral.amazon.de/

Click on Sign Up in the upper right corner.

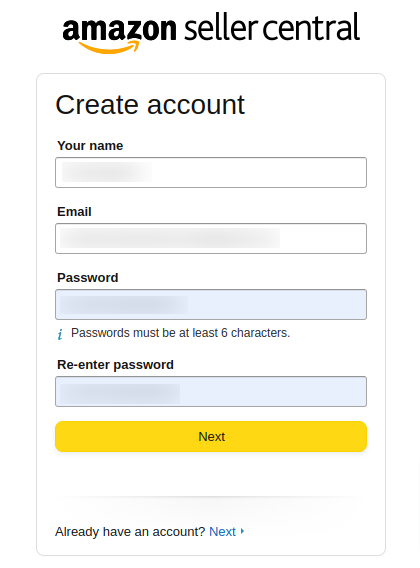

Fill in your name, email, and desired password, and click next. If you already have an account, you do not need to create another. Just proceed to log in.

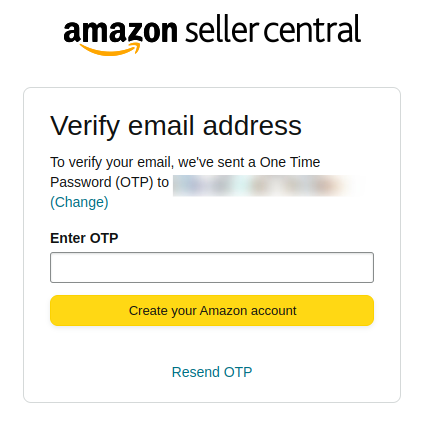

When you click next, Amazon will send an OTP to the mail you just entered. Copy it and paste it into the required field.

Proceed to click ‘Create your Amazon Account’.

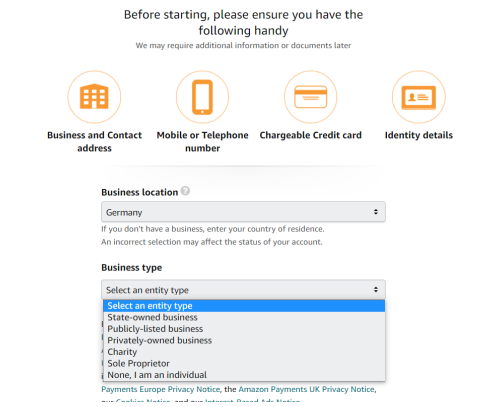

If all goes well, you should be presented with a screen listing what is required. These are a valid government-issued ID or passport, a recent bank account or credit card statement, a chargeable credit card, and a mobile phone.

This is what it should look like:

If you have the requirements ready, click ‘Begin’.

The next page will be about business information. You will be required to enter your business location, type, and business name as per the registration document. For this illustration, we will enter the business type as a sole proprietor.

Make sure you check the checkbox confirming that the details you entered are correct. Click on ‘Agree and Continue.’

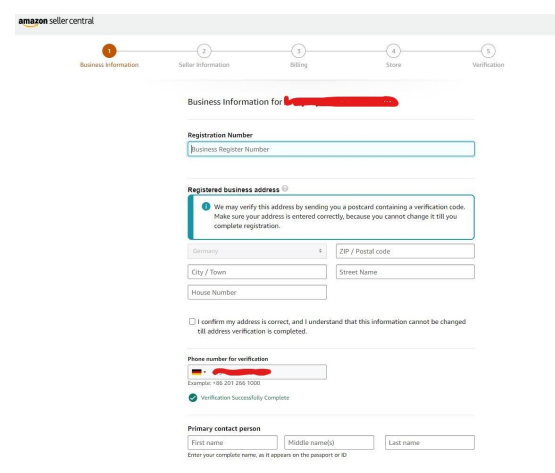

Step 4: Fill in the Business Information

The next step will require you to provide some information about your business, yourself, your credit card, store name, and ID verification. Make sure you have already obtained your Gewerbeschiein, as you will need the business registration number. This is a number starting with IGN followed by 8 digits located in the upper right corner of your Gewerbe-Anmeldung-Certificate.

You will also need to enter your number for verification purposes. Amazon will send an OTP that you will copy to the provided field.

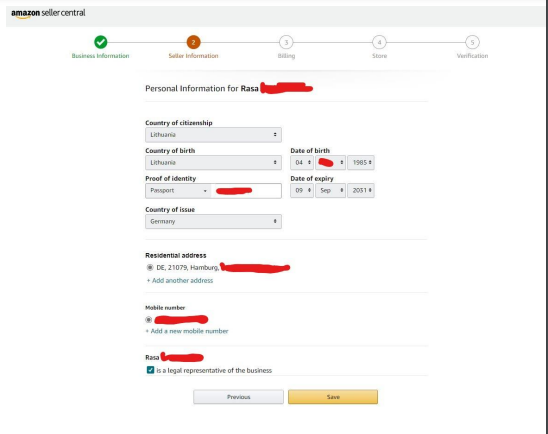

Step 5: Fill in Seller Information

The next step will be entering the seller’s information. You will need to enter your country o citizenship, country of birth, proof of identity, address, and phone number. Click save to proceed to the next step.

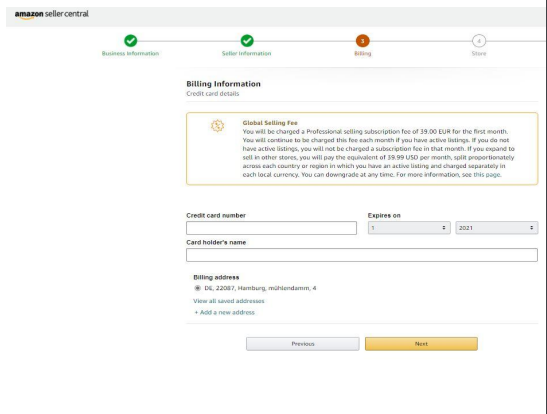

Step 6: Enter Billing Information

The next page is the billing page. You will enter your credit card details.

Your credit card will be charged a selling subscription depending on the subscription of your choice. However, take note that your credit card will only be charged if you have active listings in your account.

Your goal should be to make money as soon as possible. That way, your credit card may never have to be charged again as the subscription fee will be deducted from the proceeds of your sales.

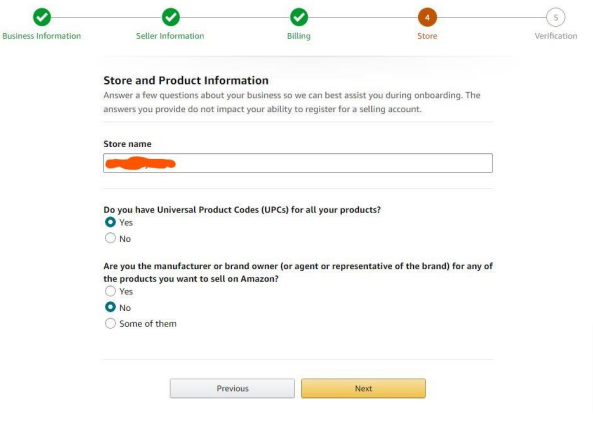

Step 7: Choose Amazon Store Name

The next step is about choosing a suitable name for your Amazon store. Don’t waste too much time here as this is not a significant factor of success. True success when selling on Amazon comes from a combination of many other factors.

You can choose any name provided that no other store has used that name. You also have to choose if you will have a unique product code for all your products. We recommend that you choose yes so that all your products can be uniquely identified by that code.

Step 8: Verification

The final step is the verification step. Here, you will confirm the details that you have entered. You will also be required to upload your identity document alongside other additional documents that you may have.

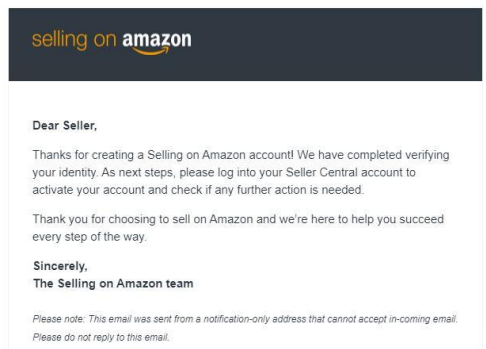

To that end, all you have to do is to wait for Amazon to confirm your account. Typically, it should take less than 10 minutes. In that case, you will receive an email similar to the one shown below:

Next Steps

If, for any reason, your seller account application is not approved, don’t be disheartened. Remember, everyone stumbles a bit when they’re getting started. The important thing is not to lose hope or give up.

Feel free to reach out to me directly using the form provided below. I’m here to help, and I’ll make sure to get back to you as soon as possible. If you’re looking for professional guidance, I also offer personal assistance via Zoom at a rate of 120 Euros. This personalized session can help you navigate through the process, address any issues you’re facing, and get you set up and ready to start selling on Amazon.

Remember, the key to success on Amazon is persistence and resilience. It may seem overwhelming at first, but with the right guidance and a positive mindset, you’ll be on your way to becoming a successful seller on Amazon.

Need a Mentor?

If you’re looking to follow in the footsteps of a successful Amazon seller, my VIP mentorship program could be just what you need. Don’t hesitate to register using the form below.

Final Word

The journey to becoming an Amazon seller can be exciting and profitable. It requires dedication, attention to detail, and an unwavering commitment to customer satisfaction. With this guide in hand, you’re well equipped to navigate the process and emerge as a successful seller on Amazon Germany in 2023.

Go ahead, take the leap, and join the world of online selling with Amazon. We’re excited to see where this journey takes you!